IRS 8867 2024-2026 free printable template

Instructions and Help about IRS 8867

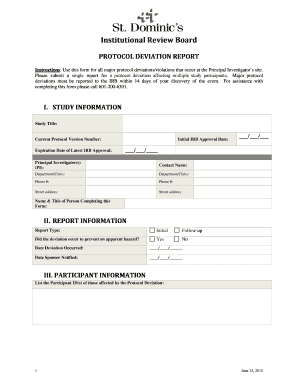

How to edit IRS 8867

How to fill out IRS 8867

Latest updates to IRS 8867

All You Need to Know About IRS 8867

What is IRS 8867?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8867

What should I do if I discover errors on my filed IRS 8867?

If you find mistakes on your filed IRS 8867, you should prepare and submit a corrected form as soon as possible. This may involve completing an amended version and clearly indicating the changes made. It's crucial to keep copies of both the original and corrected forms for your records.

How can I verify if my IRS 8867 has been received and processed?

To verify the status of your IRS 8867 submission, you can contact the IRS directly or use the IRS online tools available for tracking. Keep in mind that e-filed forms may have specific rejection codes, so familiarize yourself with these that could indicate an issue with processing.

What are the privacy measures in place for IRS 8867 filers?

When filing your IRS 8867, it’s important to ensure that your data is secure. The IRS has strict guidelines on privacy and data protection. You should also take precautions such as using secure internet connections and reputable e-filing software to enhance your data security.

Are there specific errors that commonly occur when filing IRS 8867?

Common errors when submitting IRS 8867 include incorrect taxpayer identification numbers, misreported income information, and amounts that do not align with supporting documentation. To prevent these errors, double-check your data against your financial records before submission.

What should I do if I receive an audit notice related to my IRS 8867 submission?

If you receive an audit notice related to your IRS 8867, it's important to respond promptly and gather the necessary documentation that supports your claims. Review your submitted information and ensure you can explain any discrepancies, as this will help in addressing the audit effectively.

See what our users say